38+ what percentage of income on mortgage

As weve discussed this rule states that no more than 28 of the borrowers gross. Web The rule is simple.

What Is The 28 36 Rule Lexington Law

Web What percentage of income do I need for a mortgage.

. Web Debt-To-Income Ratio - DTI. Ad Tired of Renting. With a Low Down Payment Option You Could Buy Your Own Home.

Web Ideally home buyers should put at least 20 percent down on their new dwelling but thats simply not possible for many buyers. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including. Try our mortgage calculator.

Web Beyond the Rule of 28 your overall debt-to-income ratio DTI shouldnt exceed 36. Web The total of your monthly debt payments divided by your gross monthly income which is shown as a percentage. The debt-to-income DTI ratio is a personal finance measure that compares an individuals debt payment to his or her overall.

A front-end and back-end ratio. Web Total monthly mortgage payments are typically made up of four components. When considering a mortgage make sure your.

Find A Lender That Offers Great Service. Web According to the 2836 rule your mortgage payment -- including taxes homeowners insurance and private mortgage insurance -- shouldnt go over 28. Maximum household expenses wont exceed 28 percent of your gross monthly income.

Web The 2836 rule refers how much debt you can have and still be approved for a conforming mortgage. Web A mortgage payment on an average-price home with a standard 20 down payment 30-year mortgage now adds up to 31 of the median American households. Web The 2836 is based on two calculations.

Web Once a potential home buyer has taken the time to examine their personal finances and established how much house they can afford by using the 2836 ratio. On a 400000 property a 20. A conservative approach is the 28 rule which suggests you shouldnt spend more than 28 of your gross monthly.

Your DTI is one way lenders measure your ability to manage. Ad Calculate Your Payment with 0 Down. The 36 should include your monthly mortgage payment.

Why Rent When You Could Own. Principal interest taxes and insurance collectively known as PITI. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance.

With a Low Down Payment Option You Could Buy Your Own Home. Lenders prefer you spend 28 or less of your gross monthly. Ad Finance raw land with fixed or variable rates flexible payments and no max loan amount.

Get an idea of your estimated payments or loan possibilities. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Compare More Than Just Rates.

Veterans Use This Powerful VA Loan Benefit For Your Next Home.

What Percentage Of Income Should Go To Mortgage Morty

Why Mortgage Applications Get Rejected What To Do Next

Cities With The Highest Share Of Income Going Towards Mortgage Payments Hireahelper

What Percentage Of Your Income Should Go To Mortgage Chase

The Business Credit And Financing Show Podcast Addict

What Percentage Of Income Should Go To Mortgage

Can Boston Take Cambridge S Planned Approach To Affordable Housing New 38 Story 454 Ft Residential Tower Would Be Cambridge S Tallest 465 Units 20 Affordable 5 Middle Income R Boston

Per Loan Mortgage Profits Hit Record High In Q3 2020 National Mortgage News

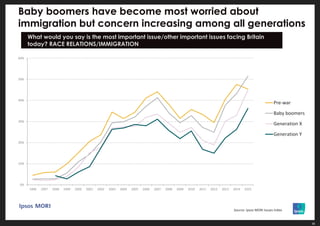

Ipsos Mori The Public Mood

Percentage Of Income For Mortgage Payments Quicken Loans

What Percentage Of Income Should Go To My Mortgage Mares Mortgage

The Percentage Of Income Rule For Mortgages Rocket Money

Pdf Not All Measures Of Income Inequality Are Equal A Comparison Between The Gini And The Zenga B Corbett Ricardas Zitikis And R Williams Academia Edu

What Percentage Of Your Income To Spend On A Mortgage

What Percentage Of Income Should Go To Mortgage

Race And Housing Series Mortgage Interest Deduction

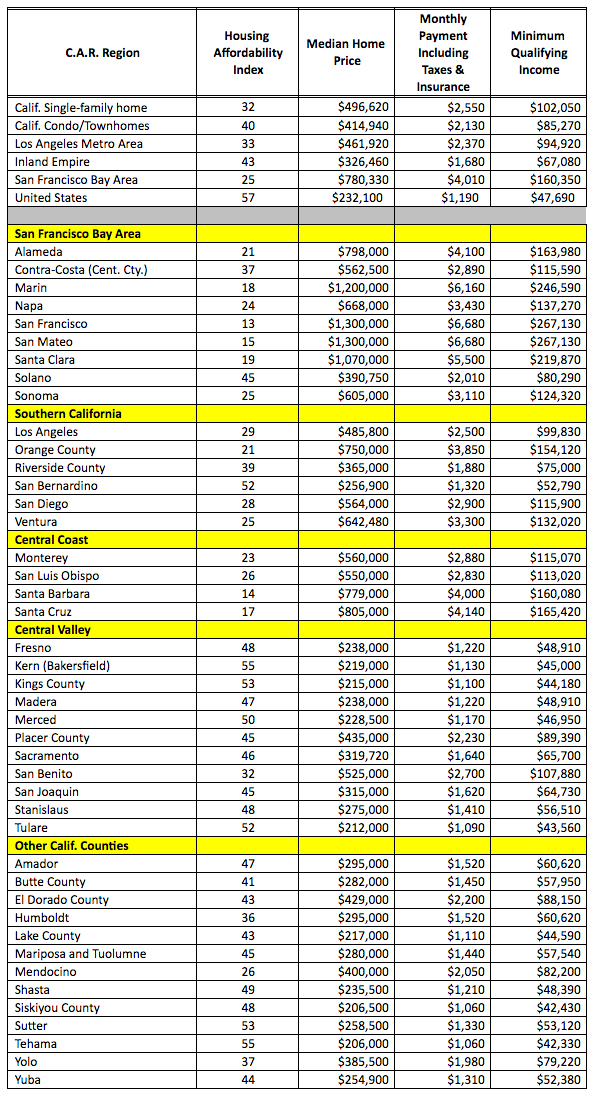

Need A Mortgage In California Realtors Say You Better Earn This Much Money Housingwire